Current Holdings

Our diversified portfolio spans multiple asset classes, carefully selected to balance growth potential with risk management.

Crypto Assets

Bitcoin (BTC)

Long-term core holding

Ethereum (ETH)

Smart contract platform

Zcash (ZEC)

Privacy-focused cryptocurrency

Avalanche (AVAX)

High-performance blockchain

Chainlink (LINK)

Decentralized oracle network

Cash Crypto

Liquid reserves

Other Altcoins

Selective growth opportunities

Traditional Assets

Delta Air Lines (DAL)

Aviation sector leader

PayPal (PYPL)

Digital payments platform

Nike (NKE)

Athletic apparel & footwear

Airbnb (ABNB)

Travel & hospitality

Lululemon (LULU)

Premium athletic wear

Coinbase (COIN)

Crypto exchange platform

ETFs (BKCH, BNO)

Blockchain & commodities exposure

High Beta Plays

Growth & speculative positions

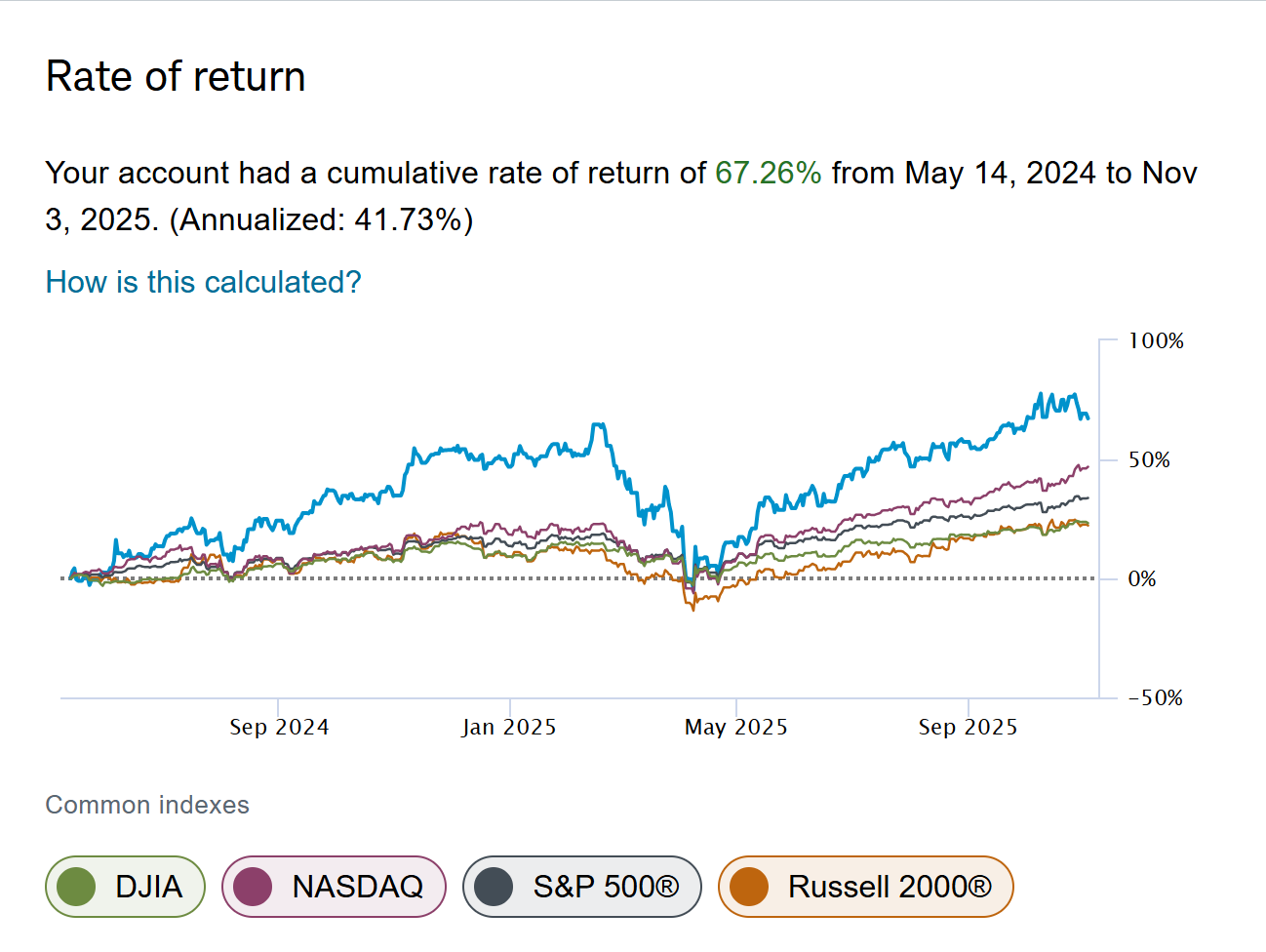

Historical Returns

May 14, 2024 - Nov 3, 2025

Our trading strategy has significantly outperformed major market indexes. Past performance is not indicative of future results.

| Portfolio/Index | Annualized Return | Outperformance |

|---|---|---|

| Prime Holding Group | 41.73% | — |

| NASDAQ | 29.79% | +11.94% |

| S&P 500® | 21.82% | +19.91% |

| DJIA | 15.20% | +26.53% |

| Russell 2000® | 14.60% | +27.13% |

* Performance data as of November 3, 2025. Returns shown are net of fees.

* Past performance is not indicative of future results. Investment involves risk.

* Benchmark data: Russell 2000®, S&P 500®, NASDAQ Composite, and Dow Jones Industrial Average (DJIA).